Market & Finance

OLA Electric IPO: Key Details and Market Reception

The highly anticipated OLA Electric IPO is now live for investors, with the company aiming to raise Rs 6,145.56 crore. The offering includes Rs 5,500 crore from fresh shares and Rs 645.56 crore through an offer for sale. Bidding for the IPO will close on August 06.

Grey Market Premium (GMP)

In the grey market, OLA Electric shares are fetching a premium of around 13% over the issue price. Although the grey market operates unofficially, it is closely watched by investors for potential listing gains.

Subscription Details

The IPO saw a subdued initial response, with a subscription rate of 0.38 times on the first day. Prior to the public offering, OLA Electric raised Rs 2,763.03 crore from anchor investors by offering 364 million shares.

- Price Band: Rs 72 to Rs 76 per equity share

- Retail Investors: Must bid for at least one lot of 195 shares, totaling Rs 14,820

- Employee Reservation: 797,101 shares reserved for employees at a Rs 7 discount per share

Key Dates:

- Allotment Finalization: August 07

- Listing Date: Expected on August 09

Company Overview

OLA Electric, primarily engaged in manufacturing electric vehicles and core components like battery packs, motors, and vehicle frames, is set to become the first pure-play electric-2W (E2W) manufacturer listed on domestic stock exchanges. The company has launched seven new products and announced four more. Backed by prominent investors such as SoftBank Investment Advisers, Tiger Global Management, and Alpha Wave Global, OLA Electric is a notable player in the market.

Expert Opinion

Choice Broking has given a “Subscribe with Caution” rating for the IPO. While they commend OLA Electric’s significant capital investments and strong market position, they highlight concerns regarding the company’s reliance on government subsidies and its current loss-making status. The future profitability of the company could be impacted if the Electric Mobility Promotion Scheme (EMPS) is not extended beyond September 2024.

Book-Running Lead Managers and Registrar

The IPO is being managed by Kotak Mahindra Capital Company, BofA Securities India, Axis Capital, SBI Capital Markets, Citigroup Global Markets India, Goldman Sachs (India) Securities, ICICI Securities, and BoB Capital Markets. Link Intime India is the registrar for the issue.

Investors are closely watching the OLA Electric IPO as it represents a significant step for the electric vehicle industry in India. The success of the IPO could set a precedent for future offerings in the rapidly growing electric mobility sector.

Business

ShapoorjiPallonji group inks record $3.4 billion private credit deal

The three-year, zero-coupon rupee bond has an annual yield of 19.75 per cent. Proceeds will primarily be used to refinance existing debt

Real estate and construction conglomerate Shapoorji Pallonji group signed a $3.4 billion private credit deal, a person familiar with the matter said, marking the biggest of its kind in the country.

The three-year, zero-coupon rupee bond has an annual yield of 19.75 per cent. Proceeds will primarily be used to refinance existing debt.

The company inked the deal with the trustee, according to the person. The money is likely to flow from lenders in the coming days, the person added.

The financing is a landmark in India’s growing private credit industry, which is getting a boost as Prime Minister Narendra Modi’s infrastructure push increases funding demands for everything from solar power to roads.

That’s fuelled a burst of competition among foreign and local investors. KKR & Co, Oaktree Capital Management and Goldman Sachs Group Inc are among the foreign firms expanding in the market.

Local players are launching araft of funds, with Kotak Alternate Asset Managers Ltd planning a $2 billion fund. Shapoorji has evolved into a family-run construction behemoth, building skyscrapers, landmarks and complex infrastructure.

Its portfolio includes the country’s central bank and the Al Alam palace for the Sultan of Oman.

About a dozen large investors, including Ares Management Corp, Cerberus Capital Management LP, Davidson Kempner Capital Management, and Farallon Capital Management were participating in the Shapoorji deal, people familiar with the matter had previously said. Deutsche Bank is also investing, and acting as the sole arranger and the trustee.

A representative for the company didn’t respond to requests for comment outside of normal business hours. The deal comes at a busy time for Indian debt markets.

Billionaire Mukesh Ambani-owned Reliance Industries has obtained a $2.98 billion-equivalent loan, according to people familiar with the matter, the largest such deal for an Indian borrower in more than a year.

Business

Carlyle-backed IT exporter Hexaware valued at $5 bn on market debut day

Institutional investors bid for nine times the shares on offer, while retail investors bid for only a tenth of the portion reserved for them amid market volatility and investor caution over IT sector

The IT services exporter is returning to public after more than four years when it was taken private by its former owner Baring Private Equity Asia.

Shares of Carlyle-backed Hexaware Technologies rose as much as 10 per cent in their debut on Wednesday, indicating rising retail interest in India’s first billion-dollar IPO that struggled to achieve full subscription without an outsized help from large institutions.

The stock began trading at Rs 745.50 on the National Stock Exchange, above its offer price of Rs 708. The blue-chip Nifty 50 index closed marginally lower.

At the day’s close of Rs 762.55, the Indian IT exporter was valued at Rs 46,340 crore ($5.34 billion). Analysts had expected a flat debut against the backdrop of single-digit premium in the indicative grey market.

“The IPO of Hexaware is a testimony to both the quality of the asset and the depth of the Indian capital markets,” said Amit Jain, managing director and head of India at US private equity firm Carlyle Group.

Institutional investors bid for nine times the shares on offer, while retail investors bid for only a tenth of the portion reserved for them amid market volatility and investor caution over the IT services sector.

Arun Kejriwal of Kejriwal Research said most large investors were not looking to push Hexaware’s share price and book their profit.

The IT services exporter is returning to public after more than four years when it was taken private by its former owner Baring Private Equity Asia.

Carlyle, which bought Hexaware in 2021, sold about 21 per cent stake in the IT services exporter through the IPO. It will continue to have a controlling stake in Hexaware after the listing as it expects more AI-driven growth, Jain said.

Brokerage JM Financial began coverage of the stock with a “buy” rating and a target price of 820 rupees, citing Hexaware’s “strategy of going after scalable clients with a wider bouquet of services”.

Business

India among top 3 least favoured Asian stock market amid multiple headwinds

On an overall basis, global fund managers expect less than 5 per cent return from Asia ex-Japan stocks in the next one year, BofA Securities’ survey findings suggest.

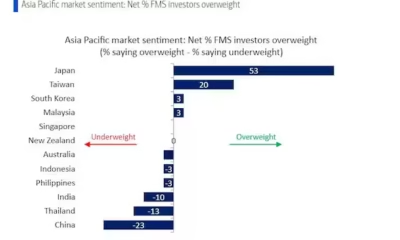

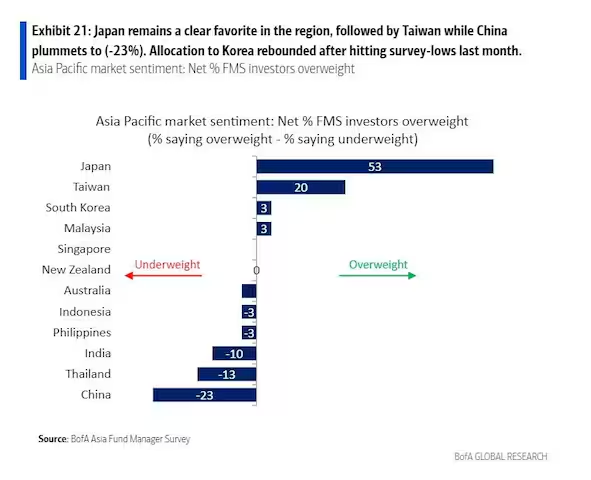

India is among the top three least favoured Asian stock markets, according to a recent note by BofA Securities, with 10 per cent of the fund managers surveyed by the research and brokerage house remaining underweight on Indian equities from a 12-month perspective.

On an overall basis, global fund managers expect less than 5 per cent return from Asia ex-Japan stocks in the next one year, BofA Securities’ survey findings suggest.

182 panelists with $513 billion worth of assets under management (AUM) responded to the global fund manager survey (FMS) questions, BofA said, while 111 panelists with $214 billion worth of AUM responded to the regional FMS questions between January 10 and 16.

Only China (with a net 23 per cent fund managers) and Thailand (13 per cent) are the other two Asian regions where fund managers are more underweight as compared to Indian equities, survey findings suggest.

In China, investor patience is being put to test yet again, BofA Securities said, as the sharp rally in September failed to hold on to the gains.

“Unsurprisingly, growth optimism faded further, with net 10 per cent expecting the economy to strengthen, down from net 61 per cent in October. Structural bearishness calls shot up to near survey-highs, while allocations nosedived to near survey-lows. FMS thinks that cash hoarding by households is here to stay, while less than 25 per cent are comfortable adding exposure on further signs of easing,” BofA Securities said.

Japan, on the other hand, was the most preferred region within Asia where a net 53 per cent of the respondents / fund managers remained overweight, followed by Taiwan (20) and South Korea (3).

“The optimism on Japan remains unscathed, as 20 per cent of the participants surveyed by BofA expect double-digit return from equities in the next 12 months,” BofA said.

Tepid 2025

Those at BNP Paribas Securities, too, see a tepid 2025 for Indian equities and expect returns to remain in single digits in the next one year.

While high-frequency indicators in India are showing signs of bottoming out, analysts at BNP Paribas Securities see other headwinds (high food inflation, high US bond yields, rising dollar index and firming up commodity prices) that are likely to keep the market sentiment in check for most part of the year.“The appetite for buying expensive emerging market equities should remain low, unless there are signs of a strong recovery in growth. Strong domestic inflows continue to support the Indian equity market, and we do not see any major risk to this. We see low likelihood of valuation multiples rerating in 2025 and expect market returns to track or slightly lag earnings growth,” wrote Kunal Vora, head of India Equity Research at BNP Paribas India in a recent note.

APAC markets

APAC ex-Japan economic outlook, according to the BofA, stayed at its second-weakest level in two years, with net 3 per cent of the participants seeing a weaker economy 12 months out versus net 39 per cent seeing a stronger economy in November.“The bearishness on the economy rubbed off on return expectations with a majority expecting less than 5 per cent returns in the APAC ex-Japan equities in the next 12 months,” BofA Securities said.

Semiconductors dominate the regional sector allocations, the survey findings suggest, followed by increasing allocations to banks and consumer staples, while real estate and materials lag.

“AI/semis, dividends/buybacks and internet are favorite China themes while in India, IT services, a beneficiary of the falling rupee, jumps to the top with infra coming next,” BofA Securities said.

-

Blog9 years ago

Blog9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Tech2 years ago

Tech2 years agoTRAI Introduces New Regulations to Boost Telecom Service Quality and Consumer Compensation

-

Blog9 years ago

Blog9 years agoThe old and New Edition cast comes together to perform

-

Blog9 years ago

Blog9 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Blog1 year ago

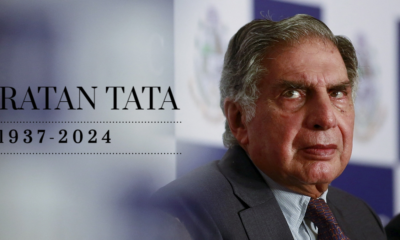

Blog1 year agoRatan Tata

-

Business2 years ago

Business2 years agoStrengthening Cyber Defenses: The Crucial Role of System Availability and Resilience

-

Business9 years ago

Business9 years ago15 Habits that could be hurting your business relationships

-

Blog9 years ago

Blog9 years agoNew Season 8 Walking Dead trailer flashes forward in time