Economy

Hindenburg says ‘it is shutting down’

Hindenburg shutting down: In a social media post on ‘X’, formerly Twitter, Hindenburg Research Founder Nate Anderson said that he had made the decision to disband Hindenburg Research

In a social media post on ‘X’, formerly Twitter, Hindenburg Research Founder Nate Anderson said that he had made the decision to disband Hindenburg Research.

“The plan has been to wind up after we finished the pipeline of ideas we were working on. And, as of the last Ponzi cases, we just completed and are sharing with regulators,” Anderson announced in a blog post shared on X.

Notably, Hindenburg Research had launched scathing attacks against Adani group firms in January 2023, alleging that the group had engaged in “stock manipulation” worth nearly Rs 18 trillion ($ 218 billion) and “accounting fraud schemes” over decades.

The US-based short-seller firm had alleged that the Adani family controlled offshore shell entities in tax havens islands/countries like Caribbean, Mauritius, and the United Arab Emirates to facilitate corruption, money laundering and taxpayer theft, while syphoning off money from the group’s listed companies.

On its part, market regulator Sebi (Securities and Exchange Board of India) had completed 22 of the 24 investigations in Adani-Hindenburg case. The market regulator had also issued show-cause notices to Hindenburg and a group entity of Adani. However, any order on the matter has not been issued yet.

Later, Hindenburg Research had accused Sebi chief Madhabi Puri Buch, stating that she had a conflict of interest in the Adani matter due to her previous investments in the group.

“Sebi was tasked with investigating investment funds relating to the Adani matter, which would include funds Buch was personally invested in and funds by the same sponsor which were specifically highlighted in our original report,” Hindenburg had said back in August 2024.

He further said that there was no one specific thing, no particular threat, no health issue, and no big personal issue behind the decision.

“Someone once told me that at a certain point, a successful career becomes a selfish act. Early on, I felt I needed to prove some things to myself. I have, now, finally found some comfort with myself, probably for the first time in my life,” Anderson explained.

I probably could have had it all along had I let myself, but I needed to put myself through a bit of hell first. The intensity and focus have come at the cost of missing a lot of the rest of the world and the people I care about. I, now, view Hindenburg as a chapter in my life, not a central thing that defines me, he added.

Business

12,000 H-1B visas: JPMorgan, Goldman among top US financial firms filing

The H-1B visa programme allows US companies to hire foreign workers in specialised fields, particularly in technology and finance

As debate over US immigration policy continues, major financial firms are increasingly turning to the H-1B visa programme to recruit skilled foreign workers. Recent filings show that the top 15 US financial firms, including JPMorgan Chase, Goldman Sachs, and Fidelity, have collectively submitted nearly 12,000 H-1B visa requests from the fourth quarter of 2023 through the third quarter of 2024, according to data available on United States Citizenship and Immigration Services (USCIS) web portal.

Financial giants turn to H-1B visas

The H-1B visa programme allows US companies to hire foreign workers in specialised fields, particularly in technology and finance.

Companies like Citi, BlackRock, and Capital One are among those actively seeking foreign talent to fill roles that require specialised skills. Technology-related jobs account for more than half of the filings, with positions such as software engineers, data scientists, and machine learning specialists in high demand.

H-1B visa filings: The number of certified H-1B filings by some of the biggest financial firms in the US, according to USCIS data:

JPMorgan Chase

1,990 filings

Roles: Software engineers, investment bankers, risk management professionals

Fidelity

1,839 filings

Roles: Software roles, AI specialists, quantitative analysts

Goldman Sachs

1,443 filings

Roles: Software engineers, divisional COO, investment banking professionals

Citi

1,058 filings

Roles: Tech roles, risk management, traders

Capital One

758 filings

Roles: Tech roles, data science, quantitative analysis

Morgan Stanley

642 filings

Roles: Associate to managing director roles

Barclays

609 filings

Roles: Tech roles, global market directors, quantitative analysis

Visa

587 filings

Roles: Machine learning engineers, software engineers, finance professionals

American Express

575 filings

Roles: Tech, data science, investment management

Bank of America

500 filings

Roles: Tech roles, senior officers in finance

Wells Fargo

453 filings

Roles: Software engineers, construction management, securities traders

Mastercard

447 filings

Roles: Software engineers, product roles, marketing and strategy experts

Charles Schwab

429 filings

Roles: Software engineers, business strategy, risk management

BlackRock

354 filings

Roles: Software engineers, sustainable investing associates

UBS

294 filings

Roles: Tech roles, investment banking directors, alternative investments

Total H-1B filings across all firms: 11,822

On the day of his inauguration on January 20, 2025, US President Donald Trump spoke about the importance of skilled immigration. “We want competent people coming into our country. And H-1B, I know the programme very well. I use the programme. Maître d’, wine experts, even waiters, high-quality waiters — you’ve got to get the best people,” Trump said. He also referenced Oracle’s Larry Ellison and Softbank’s Masayoshi Son, saying, “People like Larry, he needs engineers, Masa also needs… they need engineers like nobody’s ever needed them.”

How immigrant workers impact the US economy

Jidesh Kumar, managing partner at King Stubb & Kasiva, explained how the H-1B visa programme helps address labour shortages. “The US economy relies on H-1B visas to address skilled labour shortages, particularly in technology, finance, engineering, and healthcare, where domestic supply is insufficient,” Kumar told Business Standard. “Tech giants and startups alike depend on H-1B professionals for cutting-edge research and product development. Many also go on to become entrepreneurs, creating jobs and boosting the economy,” he added.

A report from the American Immigration Council outlines five key ways in which immigrant workers contribute to the US economy:

1. They bring unique skills that complement those of domestic workers rather than directly competing with them.

2. Their spending and investments fuel consumer demand, leading to job creation.

3. Businesses expand their US operations in response to the availability of skilled immigrant workers.

4. Many immigrants establish businesses, further expanding the job market.

5. Their innovations drive economic growth and technological advancements.

Cities benefiting from H-1B visa holders

The economic impact of the H-1B programme can be seen in major cities across the US. According to American Immigration Council, between FY 2017 and FY 2022, New York City had the highest number of H-1B petition approvals, with 372,100 (15.2% of the national total), followed by:

San Jose: 215,700

San Francisco: 165,000

Dallas: 150,200

Business

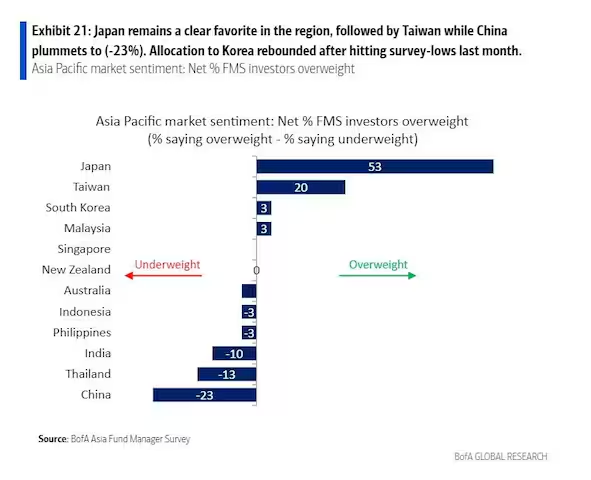

India among top 3 least favoured Asian stock market amid multiple headwinds

On an overall basis, global fund managers expect less than 5 per cent return from Asia ex-Japan stocks in the next one year, BofA Securities’ survey findings suggest.

India is among the top three least favoured Asian stock markets, according to a recent note by BofA Securities, with 10 per cent of the fund managers surveyed by the research and brokerage house remaining underweight on Indian equities from a 12-month perspective.

On an overall basis, global fund managers expect less than 5 per cent return from Asia ex-Japan stocks in the next one year, BofA Securities’ survey findings suggest.

182 panelists with $513 billion worth of assets under management (AUM) responded to the global fund manager survey (FMS) questions, BofA said, while 111 panelists with $214 billion worth of AUM responded to the regional FMS questions between January 10 and 16.

Only China (with a net 23 per cent fund managers) and Thailand (13 per cent) are the other two Asian regions where fund managers are more underweight as compared to Indian equities, survey findings suggest.

In China, investor patience is being put to test yet again, BofA Securities said, as the sharp rally in September failed to hold on to the gains.

“Unsurprisingly, growth optimism faded further, with net 10 per cent expecting the economy to strengthen, down from net 61 per cent in October. Structural bearishness calls shot up to near survey-highs, while allocations nosedived to near survey-lows. FMS thinks that cash hoarding by households is here to stay, while less than 25 per cent are comfortable adding exposure on further signs of easing,” BofA Securities said.

Japan, on the other hand, was the most preferred region within Asia where a net 53 per cent of the respondents / fund managers remained overweight, followed by Taiwan (20) and South Korea (3).

“The optimism on Japan remains unscathed, as 20 per cent of the participants surveyed by BofA expect double-digit return from equities in the next 12 months,” BofA said.

Tepid 2025

Those at BNP Paribas Securities, too, see a tepid 2025 for Indian equities and expect returns to remain in single digits in the next one year.

While high-frequency indicators in India are showing signs of bottoming out, analysts at BNP Paribas Securities see other headwinds (high food inflation, high US bond yields, rising dollar index and firming up commodity prices) that are likely to keep the market sentiment in check for most part of the year.“The appetite for buying expensive emerging market equities should remain low, unless there are signs of a strong recovery in growth. Strong domestic inflows continue to support the Indian equity market, and we do not see any major risk to this. We see low likelihood of valuation multiples rerating in 2025 and expect market returns to track or slightly lag earnings growth,” wrote Kunal Vora, head of India Equity Research at BNP Paribas India in a recent note.

APAC markets

APAC ex-Japan economic outlook, according to the BofA, stayed at its second-weakest level in two years, with net 3 per cent of the participants seeing a weaker economy 12 months out versus net 39 per cent seeing a stronger economy in November.“The bearishness on the economy rubbed off on return expectations with a majority expecting less than 5 per cent returns in the APAC ex-Japan equities in the next 12 months,” BofA Securities said.

Semiconductors dominate the regional sector allocations, the survey findings suggest, followed by increasing allocations to banks and consumer staples, while real estate and materials lag.

“AI/semis, dividends/buybacks and internet are favorite China themes while in India, IT services, a beneficiary of the falling rupee, jumps to the top with infra coming next,” BofA Securities said.

Business

Two Indian firms sanctioned by US for ‘aiding’ Russia’s Arctic LNG project

The US has announced sanctions on two Indian firms for allegedly aiding Russia’s Arctic LNG 2 project, in violation of its energy curbs aimed at crippling Moscow’s revenue streams amid the Ukraine war

The US government has announced sanctions on two Indian ship management companies for their alleged involvement in the transportation of Russia’s liquefied natural gas (LNG). The firms, the US government said, violated America’s curbs on Russia’s energy sector, the primary source of revenue fuelling Moscow’s war against Ukraine.

In a statement released on January 10, the US Department of State said the two firms, Skyhart Management Services Private Limited and Avision Shipping Services Private Limited, managed two LNG carriers that loaded cargo from the US-sanctioned Arctic LNG 2 project. Both the firms are based in Gurugram, Haryana.

“Skyhart and Avision are being designated pursuant to section 1(a)(vi)(B) of E.O. 14024 for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of LLC ARCTIC LNG 2,” the release read.

The US State Department identified two vessels – Pravasi and Onyx – as properties of Avision, which are involed in the Russian LNG transport.

Business Standard has reached out to both the firms for a comment. Their response is awaited.

Besides the two Indian firms, several Chinese firms were also sanctioned for their involvement in the Arctic LNG 2 project.

What is the Arctic LNG 2 project?

The Arctic LNG 2 project is a major liquefied natural gas (LNG) initiative in Russia, led by Novatek, one of the country’s largest natural gas producers. The project is located on the Gydan Peninsula in the Arctic region and is designed to tap into the vast natural gas reserves in the area.

France’s TotalEnergies, China’s CNPC and CNOOC, and Japan Arctic LNG (a consortium of Mitsui and JOGMEC) were the international partners involved in the project. However, after Russia’s invasion of Ukraine in February 2022 and subsequent sanctions announced by the US and its allies, France and Japan pulled out of the project.

In November 2023, the US imposed sanctions on the Arctic LNG 2 project, restricting its operations and access to international markets. In April 2024, a Reuters report indicated that Arctic LNG 2 had suspended gas liquefaction activities due to the lack of necessary tankers and the impact of sanctions.

India’s energy needs from Russia

Hit by sanctions, Russia has been offering its crude oil at discounted rates to attract buyers. India, heavily reliant on oil imports, seized this opportunity to enhance its energy security and reduce costs.

In July 2024, India imported approximately $2.8 billion worth of crude oil from Russia, accounting for nearly 40 per cent of its total oil imports. This positioned India as the second-largest buyer of Russian crude, following China.

However, in October 2024, there was a 10 per cent month-on-month decline in India’s overall crude oil imports, totaling 4.24 mbpd, according to energy cargo tracker Vortexa. Imports from Russia decreased by 7 per cent during this period, attributed to increased demand from Chinese refiners and a narrowing discount on Russian crude.

India has maintained that it won’t be buying oil from any sanctioned Russian entity. In September 2024, Oil Secretary Pankaj Jain said that India would not buy LNG the Arctic LNG 2 project due to international sanctions.

‘Last minute sanctions to help Ukraine’

Speaking about the fresh sanctions, outgoing US President Joe Biden said the move was to help Ukraine maintain its independence and fight against Moscow.

“It is probable that gas prices could increase as much as $0.03 to $0.04 a gallon, but that’s going to have a more profound impact on Russia’s ability to continue to act in the way it’s acting in the conduct of war,” Biden told reporters at a White House news conference.

“I already decided that Putin’s in tough shape right now. I think it’s really important that he does not have any breathing room to continue to do the God-awful things he’s continuing to do. As I said, he’s got his own problems economically, significant problems economically as well as politically at home,” he added.

In response, Russia’s Foreign Ministry denounced the new US sanctions, calling them an attempt to harm Russia’s economy at the risk of destabilising global markets.

-

Blog9 years ago

Blog9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Tech2 years ago

Tech2 years agoTRAI Introduces New Regulations to Boost Telecom Service Quality and Consumer Compensation

-

Blog9 years ago

Blog9 years agoThe old and New Edition cast comes together to perform

-

Blog9 years ago

Blog9 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Blog1 year ago

Blog1 year agoRatan Tata

-

Business2 years ago

Business2 years agoStrengthening Cyber Defenses: The Crucial Role of System Availability and Resilience

-

Business9 years ago

Business9 years ago15 Habits that could be hurting your business relationships

-

Business2 years ago

Business2 years agoGovt May Soften LTCG Tax Blow on Real Estate