Economy

PM Modi Highlights Budget’s Focus on Sustainable and Climate-Resilient Farming

At the 32nd International Conference of Agricultural Economists, Modi Emphasizes India’s Agricultural Advances and Digital Innovations

Prime Minister Narendra Modi, speaking at the 32nd International Conference of Agricultural Economists (ICAE) held in India for the first time in 65 years, emphasized the significant strides India has made in agriculture. Modi highlighted that the recent Union Budget 2024–25 has reinforced the commitment to creating a robust ecosystem for Indian farmers, focusing on sustainable and climate-resilient farming practices.

Addressing an audience of about 1,000 delegates from around 70 countries, Modi reflected on India’s transformation from a nation grappling with food security challenges to one that is now a global leader in food production. “India is now a food surplus country,” he declared, noting the country’s status as the top producer of milk, pulses, and spices, and the second-largest producer of food grains, fruits, vegetables, cotton, sugar, and tea. Modi emphasized that India’s progress now positions it as a key player in addressing global food and nutritional security challenges.

The Prime Minister underscored the central role of agriculture in India’s economic policies and detailed the government’s efforts over the past decade to support the sector’s growth. He highlighted that nearly 90% of Indian farmers own relatively small land holdings and play a crucial role in ensuring the country’s food security. Modi pointed out that India has developed 1,900 new crop varieties adapted to climate change over the last ten years.

Modi also addressed critical issues such as water scarcity, climate change, and nutrition. He advocated for the use of millet, or Shri Anna, as a solution due to its high yield and low water requirements. He mentioned India’s readiness to share its millet resources globally.

In his speech, Modi showcased how India is integrating digital technologies into agriculture. He highlighted the PM Kisan Samman Nidhi, which facilitates direct financial transfers to the bank accounts of 10 crore farmers, and the digital public infrastructure for crop surveys that provide real-time data to farmers. Modi also discussed the promotion of drones in farming and the creation of digital identities for land, alongside a drive to digitize land records and train “drone didis” to operate them. He concluded that these initiatives will not only benefit Indian farmers but also enhance global food security.

(with inputs from PTI)

Business

12,000 H-1B visas: JPMorgan, Goldman among top US financial firms filing

The H-1B visa programme allows US companies to hire foreign workers in specialised fields, particularly in technology and finance

As debate over US immigration policy continues, major financial firms are increasingly turning to the H-1B visa programme to recruit skilled foreign workers. Recent filings show that the top 15 US financial firms, including JPMorgan Chase, Goldman Sachs, and Fidelity, have collectively submitted nearly 12,000 H-1B visa requests from the fourth quarter of 2023 through the third quarter of 2024, according to data available on United States Citizenship and Immigration Services (USCIS) web portal.

Financial giants turn to H-1B visas

The H-1B visa programme allows US companies to hire foreign workers in specialised fields, particularly in technology and finance.

Companies like Citi, BlackRock, and Capital One are among those actively seeking foreign talent to fill roles that require specialised skills. Technology-related jobs account for more than half of the filings, with positions such as software engineers, data scientists, and machine learning specialists in high demand.

H-1B visa filings: The number of certified H-1B filings by some of the biggest financial firms in the US, according to USCIS data:

JPMorgan Chase

1,990 filings

Roles: Software engineers, investment bankers, risk management professionals

Fidelity

1,839 filings

Roles: Software roles, AI specialists, quantitative analysts

Goldman Sachs

1,443 filings

Roles: Software engineers, divisional COO, investment banking professionals

Citi

1,058 filings

Roles: Tech roles, risk management, traders

Capital One

758 filings

Roles: Tech roles, data science, quantitative analysis

Morgan Stanley

642 filings

Roles: Associate to managing director roles

Barclays

609 filings

Roles: Tech roles, global market directors, quantitative analysis

Visa

587 filings

Roles: Machine learning engineers, software engineers, finance professionals

American Express

575 filings

Roles: Tech, data science, investment management

Bank of America

500 filings

Roles: Tech roles, senior officers in finance

Wells Fargo

453 filings

Roles: Software engineers, construction management, securities traders

Mastercard

447 filings

Roles: Software engineers, product roles, marketing and strategy experts

Charles Schwab

429 filings

Roles: Software engineers, business strategy, risk management

BlackRock

354 filings

Roles: Software engineers, sustainable investing associates

UBS

294 filings

Roles: Tech roles, investment banking directors, alternative investments

Total H-1B filings across all firms: 11,822

On the day of his inauguration on January 20, 2025, US President Donald Trump spoke about the importance of skilled immigration. “We want competent people coming into our country. And H-1B, I know the programme very well. I use the programme. Maître d’, wine experts, even waiters, high-quality waiters — you’ve got to get the best people,” Trump said. He also referenced Oracle’s Larry Ellison and Softbank’s Masayoshi Son, saying, “People like Larry, he needs engineers, Masa also needs… they need engineers like nobody’s ever needed them.”

How immigrant workers impact the US economy

Jidesh Kumar, managing partner at King Stubb & Kasiva, explained how the H-1B visa programme helps address labour shortages. “The US economy relies on H-1B visas to address skilled labour shortages, particularly in technology, finance, engineering, and healthcare, where domestic supply is insufficient,” Kumar told Business Standard. “Tech giants and startups alike depend on H-1B professionals for cutting-edge research and product development. Many also go on to become entrepreneurs, creating jobs and boosting the economy,” he added.

A report from the American Immigration Council outlines five key ways in which immigrant workers contribute to the US economy:

1. They bring unique skills that complement those of domestic workers rather than directly competing with them.

2. Their spending and investments fuel consumer demand, leading to job creation.

3. Businesses expand their US operations in response to the availability of skilled immigrant workers.

4. Many immigrants establish businesses, further expanding the job market.

5. Their innovations drive economic growth and technological advancements.

Cities benefiting from H-1B visa holders

The economic impact of the H-1B programme can be seen in major cities across the US. According to American Immigration Council, between FY 2017 and FY 2022, New York City had the highest number of H-1B petition approvals, with 372,100 (15.2% of the national total), followed by:

San Jose: 215,700

San Francisco: 165,000

Dallas: 150,200

Business

India among top 3 least favoured Asian stock market amid multiple headwinds

On an overall basis, global fund managers expect less than 5 per cent return from Asia ex-Japan stocks in the next one year, BofA Securities’ survey findings suggest.

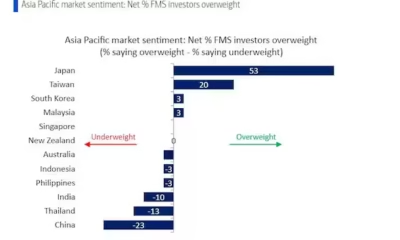

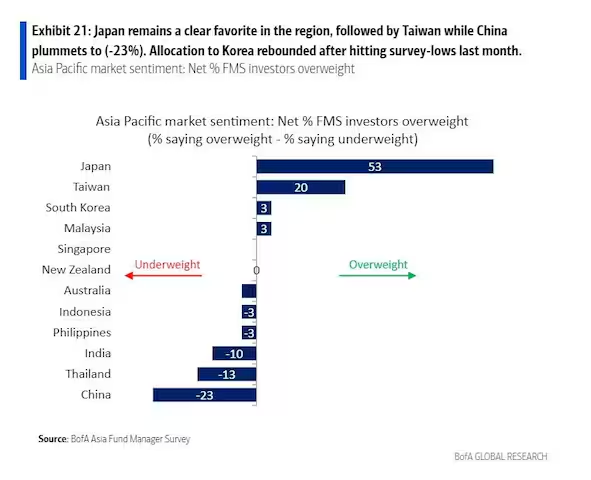

India is among the top three least favoured Asian stock markets, according to a recent note by BofA Securities, with 10 per cent of the fund managers surveyed by the research and brokerage house remaining underweight on Indian equities from a 12-month perspective.

On an overall basis, global fund managers expect less than 5 per cent return from Asia ex-Japan stocks in the next one year, BofA Securities’ survey findings suggest.

182 panelists with $513 billion worth of assets under management (AUM) responded to the global fund manager survey (FMS) questions, BofA said, while 111 panelists with $214 billion worth of AUM responded to the regional FMS questions between January 10 and 16.

Only China (with a net 23 per cent fund managers) and Thailand (13 per cent) are the other two Asian regions where fund managers are more underweight as compared to Indian equities, survey findings suggest.

In China, investor patience is being put to test yet again, BofA Securities said, as the sharp rally in September failed to hold on to the gains.

“Unsurprisingly, growth optimism faded further, with net 10 per cent expecting the economy to strengthen, down from net 61 per cent in October. Structural bearishness calls shot up to near survey-highs, while allocations nosedived to near survey-lows. FMS thinks that cash hoarding by households is here to stay, while less than 25 per cent are comfortable adding exposure on further signs of easing,” BofA Securities said.

Japan, on the other hand, was the most preferred region within Asia where a net 53 per cent of the respondents / fund managers remained overweight, followed by Taiwan (20) and South Korea (3).

“The optimism on Japan remains unscathed, as 20 per cent of the participants surveyed by BofA expect double-digit return from equities in the next 12 months,” BofA said.

Tepid 2025

Those at BNP Paribas Securities, too, see a tepid 2025 for Indian equities and expect returns to remain in single digits in the next one year.

While high-frequency indicators in India are showing signs of bottoming out, analysts at BNP Paribas Securities see other headwinds (high food inflation, high US bond yields, rising dollar index and firming up commodity prices) that are likely to keep the market sentiment in check for most part of the year.“The appetite for buying expensive emerging market equities should remain low, unless there are signs of a strong recovery in growth. Strong domestic inflows continue to support the Indian equity market, and we do not see any major risk to this. We see low likelihood of valuation multiples rerating in 2025 and expect market returns to track or slightly lag earnings growth,” wrote Kunal Vora, head of India Equity Research at BNP Paribas India in a recent note.

APAC markets

APAC ex-Japan economic outlook, according to the BofA, stayed at its second-weakest level in two years, with net 3 per cent of the participants seeing a weaker economy 12 months out versus net 39 per cent seeing a stronger economy in November.“The bearishness on the economy rubbed off on return expectations with a majority expecting less than 5 per cent returns in the APAC ex-Japan equities in the next 12 months,” BofA Securities said.

Semiconductors dominate the regional sector allocations, the survey findings suggest, followed by increasing allocations to banks and consumer staples, while real estate and materials lag.

“AI/semis, dividends/buybacks and internet are favorite China themes while in India, IT services, a beneficiary of the falling rupee, jumps to the top with infra coming next,” BofA Securities said.

Economy

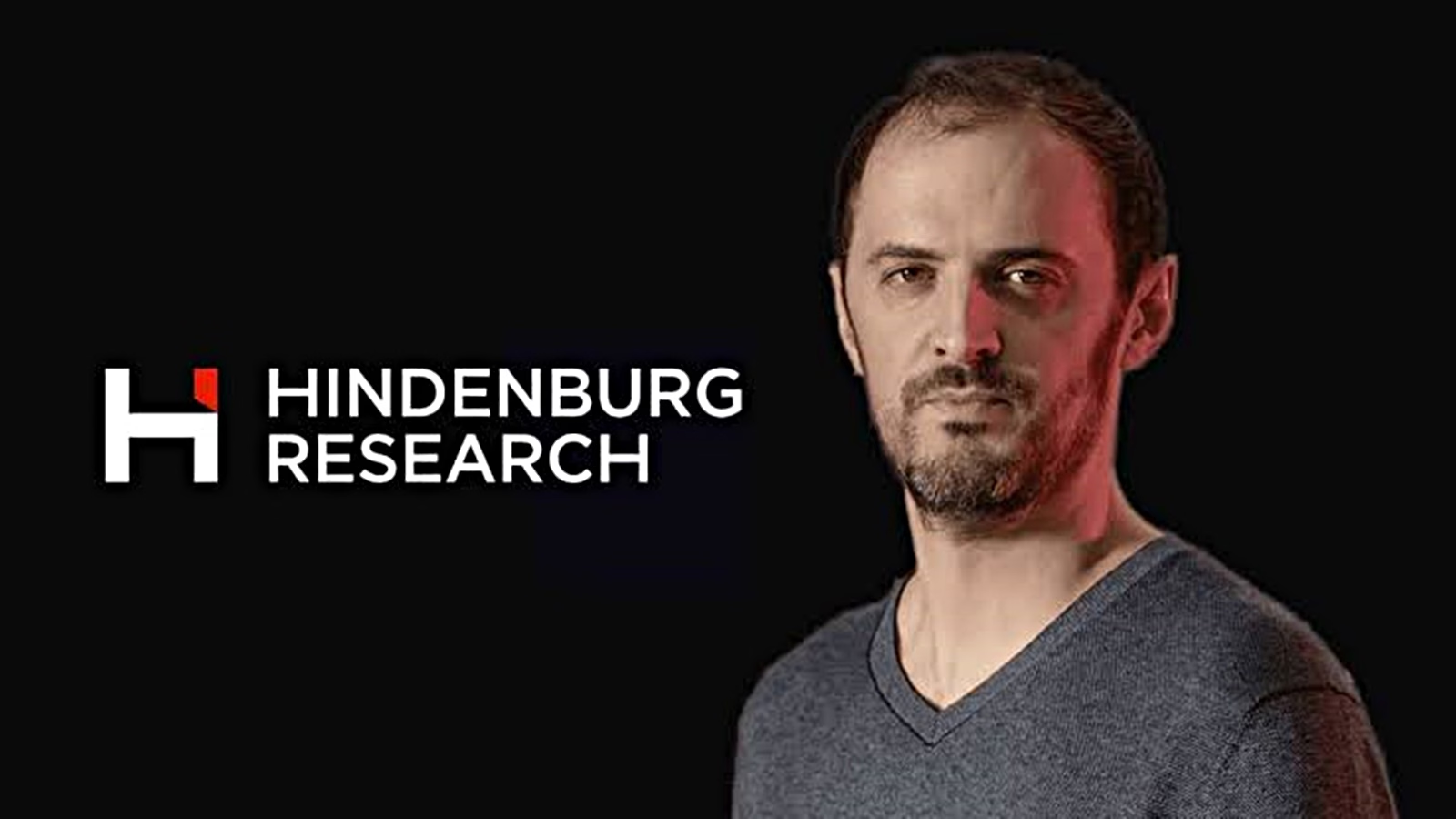

Hindenburg says ‘it is shutting down’

Hindenburg shutting down: In a social media post on ‘X’, formerly Twitter, Hindenburg Research Founder Nate Anderson said that he had made the decision to disband Hindenburg Research

In a social media post on ‘X’, formerly Twitter, Hindenburg Research Founder Nate Anderson said that he had made the decision to disband Hindenburg Research.

“The plan has been to wind up after we finished the pipeline of ideas we were working on. And, as of the last Ponzi cases, we just completed and are sharing with regulators,” Anderson announced in a blog post shared on X.

Notably, Hindenburg Research had launched scathing attacks against Adani group firms in January 2023, alleging that the group had engaged in “stock manipulation” worth nearly Rs 18 trillion ($ 218 billion) and “accounting fraud schemes” over decades.

The US-based short-seller firm had alleged that the Adani family controlled offshore shell entities in tax havens islands/countries like Caribbean, Mauritius, and the United Arab Emirates to facilitate corruption, money laundering and taxpayer theft, while syphoning off money from the group’s listed companies.

On its part, market regulator Sebi (Securities and Exchange Board of India) had completed 22 of the 24 investigations in Adani-Hindenburg case. The market regulator had also issued show-cause notices to Hindenburg and a group entity of Adani. However, any order on the matter has not been issued yet.

Later, Hindenburg Research had accused Sebi chief Madhabi Puri Buch, stating that she had a conflict of interest in the Adani matter due to her previous investments in the group.

“Sebi was tasked with investigating investment funds relating to the Adani matter, which would include funds Buch was personally invested in and funds by the same sponsor which were specifically highlighted in our original report,” Hindenburg had said back in August 2024.

He further said that there was no one specific thing, no particular threat, no health issue, and no big personal issue behind the decision.

“Someone once told me that at a certain point, a successful career becomes a selfish act. Early on, I felt I needed to prove some things to myself. I have, now, finally found some comfort with myself, probably for the first time in my life,” Anderson explained.

I probably could have had it all along had I let myself, but I needed to put myself through a bit of hell first. The intensity and focus have come at the cost of missing a lot of the rest of the world and the people I care about. I, now, view Hindenburg as a chapter in my life, not a central thing that defines me, he added.

-

Blog9 years ago

Blog9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Tech2 years ago

Tech2 years agoTRAI Introduces New Regulations to Boost Telecom Service Quality and Consumer Compensation

-

Blog9 years ago

Blog9 years agoThe old and New Edition cast comes together to perform

-

Blog9 years ago

Blog9 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Blog1 year ago

Blog1 year agoRatan Tata

-

Business2 years ago

Business2 years agoStrengthening Cyber Defenses: The Crucial Role of System Availability and Resilience

-

Business9 years ago

Business9 years ago15 Habits that could be hurting your business relationships

-

Blog9 years ago

Blog9 years agoNew Season 8 Walking Dead trailer flashes forward in time